For new investors just beginning their trip into futures trading, 해외선물 the ever-fluctuating financial markets can be frightening. Luckily, there is a tried as well as real technique of comprehending market trends: the Elliott Wave Theory. With it comes a comprehensive check out past as well as present motions to outfit you with insightful predictions for future trades – permitting you to make sensible choices that move your portfolio ahead!

What is the Elliott Wave Theory?

Created in the 1930s, Ralph Nelson Elliott’s Elliot Wave Theory changed technical analysis by introducing a strategic framework based on market wave cycles. The premise of this theory? That financial markets move naturally– developing cyclic patterns that can then be used to prepare for future trends and also develop viable trading techniques. With over eighty years of effective application under its belt, the Elliott Wave Theory remains to remain an integral sign for wise capitalists worldwide.

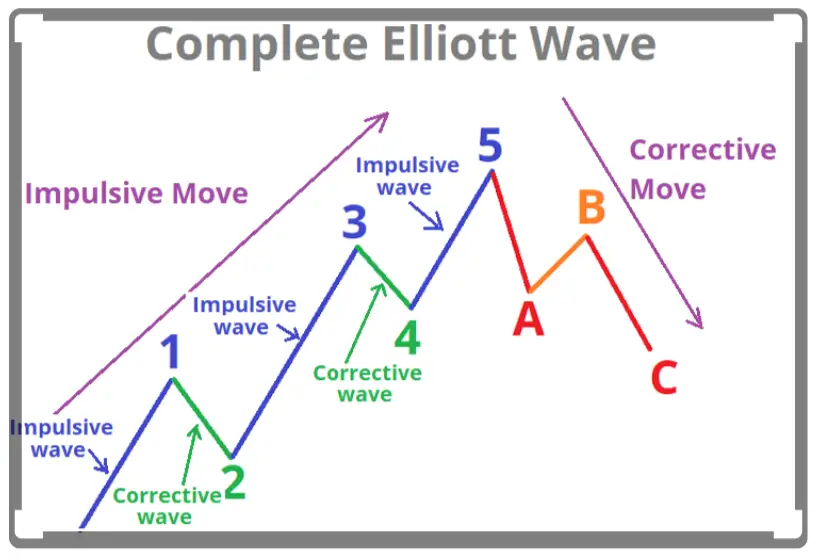

The Elliott Wave Principle consists of 2 sorts of waves: 선물옵션 impulsive and corrective. Impulsive waves are the major directional movement of the market, while corrective waves move against the major fad. The impulsive waves are additional separated into 5 sub-waves, while the corrective waves are separated right into 3 sub-waves.

Using Elliott Wave Theory in Futures Trading

Elliott Wave Theory provides an important tool for futures traders wanting to take advantage of possibilities in the marketplace. By utilizing historic data, investors can recognize leading fads and after that utilize this understanding to discover prospective trading openings produced by waves of tasks within these larger movements – a powerful approach that can aid optimize their earnings!

Traders need to be able to recognize the impulsive and corrective waves within the overall trend. This can be done by analyzing charts and also looking for particular patterns. As an example, an impulsive wave will have a more powerful upward or downward movement, while a corrective wave will certainly have a weak motion against the major trend.

Traders can leverage the Elliott Wave Theory to forecast potential market motion. By recognizing which wave is trending– impulsive or corrective– capitalists are empowered with expertise to make sound, computed trades as well as reduce danger along their trip in trading.

Limitations of Elliott Wave Theory

Regardless Of the Elliott Wave Theory being an useful 해외선물커뮤니티 device for futures traders, there are constraints to bear in mind. Its intricacy makes it hard to precisely identify wave counts which can bring about stopped working predictions and ill informed trading decisions.

In spite of its effective analysis of previous market fads, Elliott Wave Theory has difficulty projecting ideal results in volatile markets as a result of their uncertain nature.

Final thought

By leveraging the Elliott Wave Theory, traders can get 해외선물사이트 an advantage in anticipating future market activities as well as remain ahead of their competitors. This effective tool enables informed choices to be made relative to risk as well as potential trading possibilities. Keep in mind though – no single concept ought to ever run in a vacuum; combining it with various other technical evaluation tools is crucial for best outcomes!