While Bitcoin remains the flagship cryptocurrency, the crypto market is brimming with a diverse array of digital assets known as altcoins. Beyond investing in these altcoins, traders can explore a dynamic avenue for potential profits through Altcoin Futures Trading. Let’s embark on a journey into the world of altcoin futures trading and uncover the opportunities it presents.

Understanding Altcoin Futures Trading

Trade altcoin futures to profit from price movements without owning the assets. Speculate on the future price of alternative cryptocurrencies through futures contracts. Buy or sell altcoins at a fixed price on a specific date. Boost your investment strategy with altcoin futures trading.

The Appeal of Altcoin Futures Trading 코인선물

1. Diversification

Expand your investment horizons with altcoin futures trading. Move beyond Bitcoin and diversify your portfolio. Take advantage of the abundance of altcoins and access a diverse range of assets to spread your risk effectively.

2. Leverage for Amplified Gains

Leverage is a powerful tool in futures trading. Traders can use a smaller amount of capital to control a larger position size, amplifying potential gains. However, leverage also magnifies potential losses, necessitating careful risk management.

3. Hedging Opportunities

Altcoin futures can serve as effective hedging instruments. Traders who hold altcoin positions can use futures contracts to mitigate potential losses during adverse price movements.

4. Market Accessibility

Altcoin futures trading allows participation in both rising and falling markets. Traders can profit from upward price trends (long positions) as well as downward trends (short positions), offering more opportunities for profit.

Navigating Altcoin Futures Trading

1. Research and Due Diligence

Before diving into altcoin futures trading, thorough research is essential. Understand the altcoin’s technology, use case, team, and market trends. Informed decisions are crucial for success.

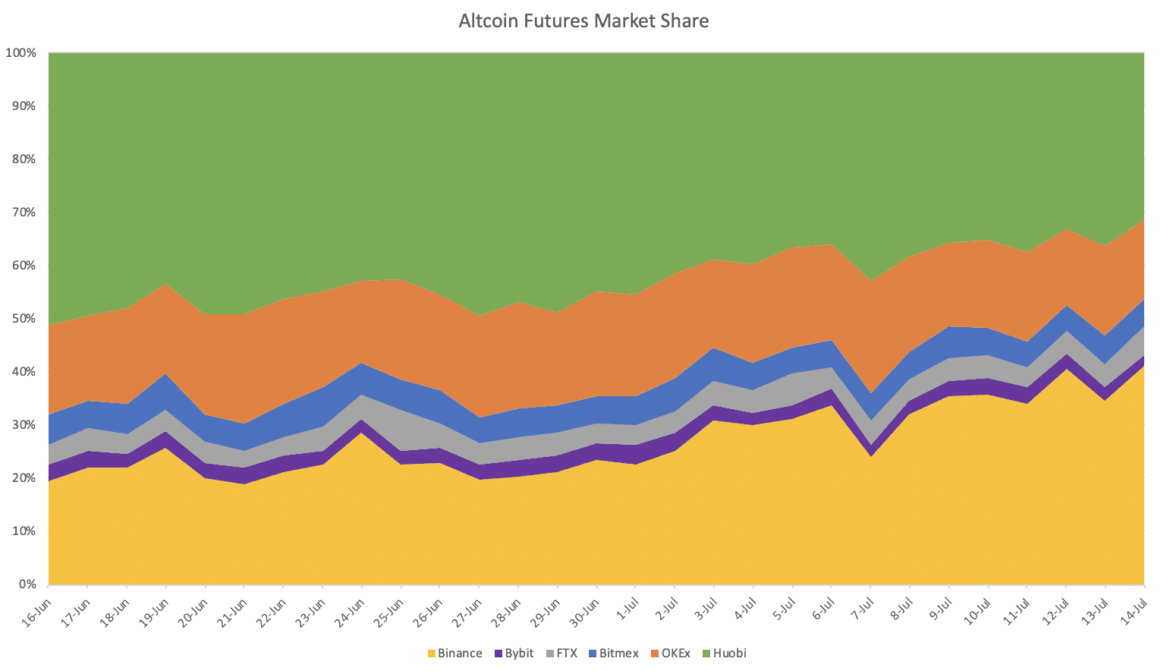

2. Choose Reputable Exchanges

When choosing an exchange for altcoin futures trading, it is crucial to select a highly regarded one. Look for an exchange that not only offers a wide range of altcoin futures but also prioritizes secure trading. Additionally, consider the competitiveness of their fees and the ease of use of their interface.

3. Risk Management

Given the volatile nature of altcoins, risk management is paramount. Set clear stop-loss orders, determine your risk tolerance, and never invest more than you can afford to lose.

In Conclusion

Altcoin futures trading extends beyond Bitcoin, presenting a realm of opportunities for traders seeking exposure to a diverse range of digital assets. With the potential for diversification, leverage, hedging, and market accessibility, altcoin futures trading offers a multifaceted approach to navigating the dynamic cryptocurrency market.